10 Easy Facts About Unicorn Financial Services Shown

Wiki Article

Our Home Loan Broker Melbourne PDFs

Table of ContentsThe 6-Minute Rule for Melbourne Mortgage BrokersBroker Melbourne for BeginnersThe Definitive Guide to Home Loan Broker MelbourneAn Unbiased View of Refinance Broker MelbourneMortgage Broker In Melbourne - Truths

Consequently, making use of one might suggest cutting off certain borrowing opportunities that would otherwise be a great fit. See to it the offer your broker is getting you is worth the fee you pay. If your broker is paid by the lender, you may be pushed to sign with the lender who pays the broker the most significant commission.Do some research study as well as comprehend your broker's charges before signing anything. If you don't have time to sink into the mortgage application procedure, or if you remain in a hurry to safeguard a mortgage, working with a broker is a smart selection. Simply understand the prospective drawbacks entailed. Do not just pick an arbitrary broker.

Despite having whole lots of endorsements, be sure to ask a lot of questions prior to consenting to deal with a home mortgage broker. Find out just how that broker earns money and obtain a sense of his/her experience. A favorable home loan price can save your savings account long-term. A home loan broker could be your ticket to a reduced rate of interest-- so if you don't have the time or perseverance to get home mortgages yourself, or want a person in your corner who recognizes how to discuss prices, speak to a home loan broker.

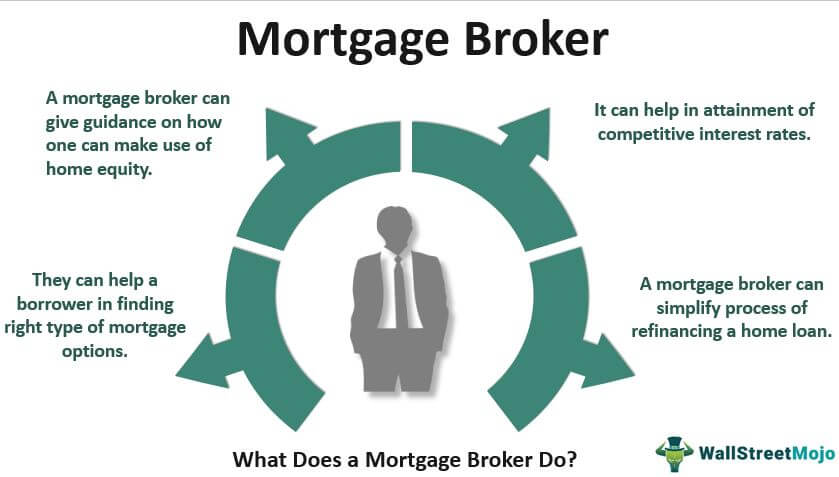

A financial institution will provide the borrower with the choices they can offerthat can be simply two or three loan products. A home loan broker, by comparison, will certainly know loads of loans and also plans, and will certainly suggest those which are optimum to the loan provider. If a prospective consumer is refused by a bank because they do not certify for its loaning program, the individual might be prevented from attempting againwhen in fact a mortgage broker can have informed them that they might be approved by a various lending institution with a different policy.

Refinance Melbourne Things To Know Before You Get This

If it is dropping far short, she might recommend that the home loan holder undertakes re-financing to acquire a different passion price. A broker is not forced to have regular check-ins. Some brokers are paid higher or reduced costs for specific items, while others receive a level fee.

46% to 0. 65% of the total loan quantity. The trail commission is paid monthly as well as it varies in between 0 (home loan broker melbourne). 1% to 0. 35% of the worth of the mortgage. Some brokers are starting to bill the borrower a charge along with charging the lender. This is because a considerable quantity of effort can be taken on just for the borrower to walk away before validities are participated in.

There are several ways to obtain a mortgage lending. You can go directly to your financial institution or cooperative credit union and also use a dedicated home mortgage company or on-line lending institution, or you can ask a home mortgage broker to do it all for you. Mortgage brokers put simply, are middlemen who work as intermediaries in between customers as well as loan providers. Though the use of home mortgage brokers has actually wound down over the last decade, many buyers are considering this course once again due to the special worth it can offerparticularly for those who are freelance, have no W2 earnings, or are taking care of poor credit history. A home loan broker aids customers discover the most effective finance as well as guides them via the process.

Home Loan Broker Melbourne Can Be Fun For Anyone

Some mortgage brokers supply "no-cost" loans, but you will certainly still Click This Link pay for the solution via the rate of interest rate. Before working with a home loan broker, make certain to research the broker and also conduct a screening meeting.

They'll look to discover you the best financing item for your distinct credit score, revenue, and homebuying circumstance, and they'll aid you focus in on the most affordable interest rate feasible. They'll also spearhead the whole mortgage process. https://herobizlistings.com/mortgage-broker/unicorn-financial-services-springvale-victoria/. Your broker will certainly collect up your documents, submit all your applications, and collaborate with your selected lender to obtain your finance refined swiftly and efficiently.

Mortgage brokers can be paid in a number of means. They are paid a commission that differs per broker and lending institution. This commission is paid by the borrower upon closing or the lender. Some brokers offer what are called "no-cost" fundings, which means the debtor pays no cost or cost to collaborate with the broker.

The big difference in between mortgage brokers and typical funding policemans is that brokers are paid on a per-transaction basis. They stand to gain more with every finance they refine and also make money much more on larger-size fundings. Loan officers, on the other hand, obtain an established yearly income, so they're not as encouraged by quantity or car loan size.

The 10-Second Trick For Home Loan Broker Melbourne

They can often have specific costs waived due to their lending institution partnerships. Cons Brokers may utilize non-local lending institutions who are not familiar with your area's subtleties and special demands.

Brokers might have less control over your loan file and also just how it's processed, since it is not being taken care of internally. Buyers that have special financial scenarios (freelance, have inconsistent or non-W2 earnings or have less-than-stellar credit scores) are usually best served by a home mortgage broker.

If you don't have time to go shopping around for a home mortgage yourself (a must, offered the number of loan providers and differing prices available) or you require to guarantee a fast turnaround on your application, a home loan broker can additionally be a wise option. If you do locate that a home loan broker is the ideal move for your future residence purchase, make sure to do your due persistance.

More About Broker Melbourne

Ask inquiries, and also consider speaking with at the very least three brokers before picking who to select. Bear in mind, the loan your broker locates you will certainly impact the following 10, 20, and even thirty years of your life. melbourne broker. Ensure they're knowledgeable, linked, and outfitted to provide you the absolute finest product for your demands, as well as ask friends, family members, and your property representative for references.

At the end of the day, you'll want something that makes the process as structured and also stress-free as possible. Instead coming close to a bank right off the bat, have you ever before taken into consideration using a home loan broker?

Report this wiki page